Creating an e-wallet application is undoubtedly tricky.

The complexities, compliance laws, and competition are the main pain points in the creation process.

However, this guide will make it super easy to understand how to develop a digital wallet.

You’ll find this guide particularly helpful if you’re a startup founder, serial entrepreneur, tech executive, or anyone seeking knowledge about how to develop an e-wallet app.

In this article, we’ll educate you about the following:

- Insights on digital wallet startups

- Examples of e-wallets

- Growth projection of digital wallet usage

- Step-by-Step guide on e-wallet app development

- And more!

Perhaps you have a preference for pictorial description over text, then check out our infographic section for images on how to develop a digital wallet app.

Let’s discuss the nitty-gritty of the article:

Looking for an eWallet mobile app development company to create a custom eWallet app that perfectly fits your business needs and goals?

Get a free 30-minute consultation with us to know how an eWallet application can benefit your customers with a seamless payment experience.

Essential Information About E-Wallet Startups

Let’s provide insight into e-wallet development, market overview, and projections, and Venture Capital investment in e-wallet startups.

What is a Digital Wallet?

A digital wallet is an application that mimics the physical wallet, allowing consumers to make purchases via a mobile app. They offer payment via smart devices, computers, and smartphones. Samsung Pay, Google Pay, Venmo, and PayPal are wallets in this category.

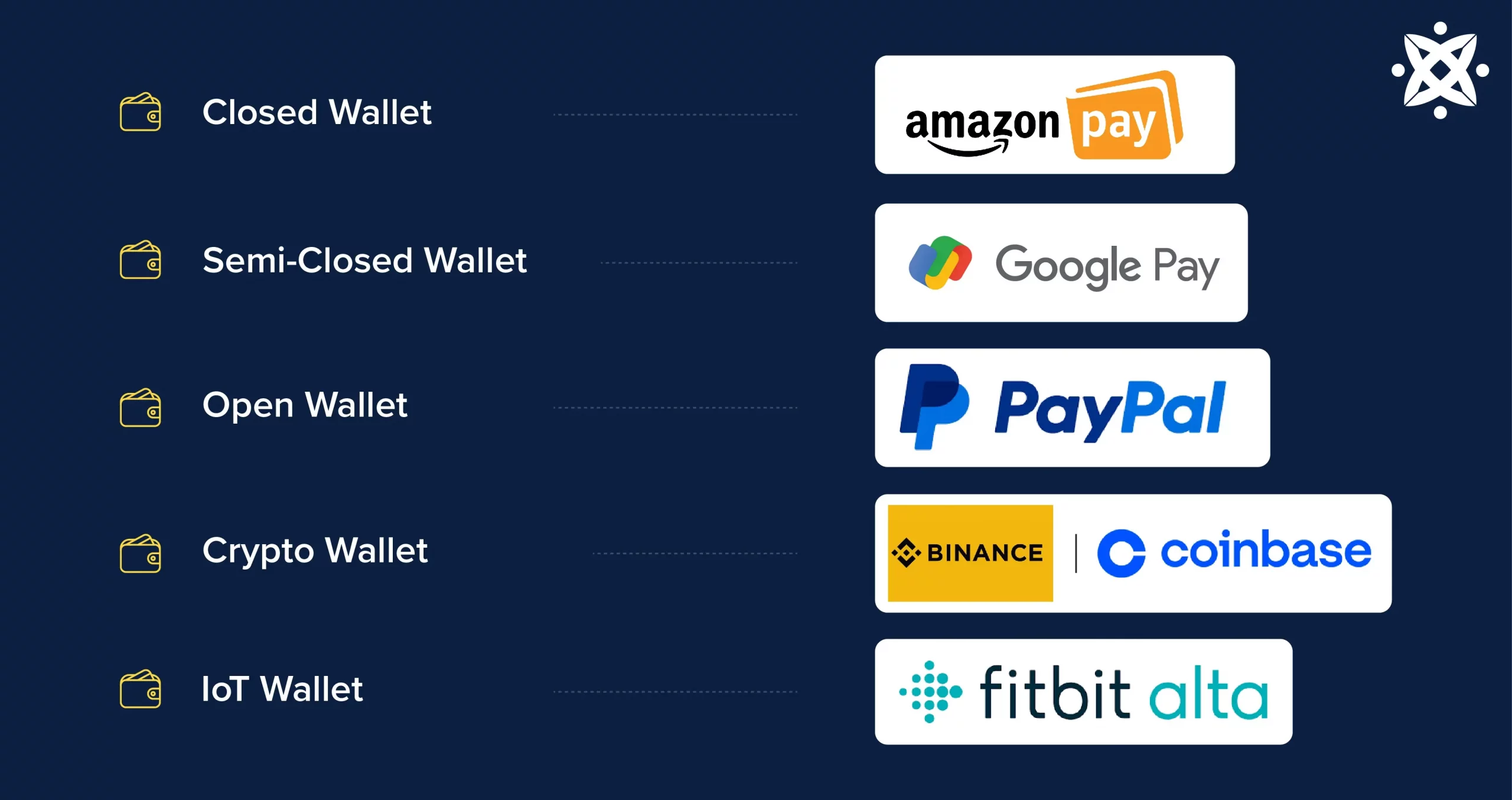

Some Types of mobile wallet solutions are:

Closed: This is a type of electronic payment solution that can only be used for a company or brand.

An example here is Amazon Pay.

Semi-closed: This solution offers more options to e-commerce sites and offline retailers.

Only merchants with previous agreements with the issuer can accept payments on a semi-closed platform.

Google Pay India is a perfect example of this.

Open: Open wallets are issued by fintech and banks for the populace to initiate and accept payments.

An example of an app here is PayPal.

Crypto: Apps in this category are designed to store and transfer cryptocurrencies like Ethereum, Bitcoin, etc.

Examples of applications in this category are Binance, Brace, Coinbase, etc.

IoT: These applications enable payments from appliances, wearable devices, and everyday objects.

An example of an app in this category is Fitbit Pay.

💡 Market Overview for E-Wallet Startups

Statistics from numerous sources show that digital wallet startups enjoy high patronage. Some impressive statistics prove that:

- The digital market industry is expected to enjoy a CAGR of 27.4% from 2022 to 2030.

- Digital payment market volume is expected to be $15.17 trillion by 2027.

- 82% of US consumers currently use mobile digital payment.

- The United States currently has over 273.76 million phones that can use e-wallet mobile apps.

Another reason to build digital payment apps is investors’ interest in the sector.

Venture Capital Investment in Mobile App Digital Wallet Startups

Reports from reputable agencies show that startups in the cards mobile wallet industry are getting a huge chunk of the over $1 trillion invested in Fintech.

Let’s give you some insight into investor readiness for this sector:

- Payoneer raised $180 million for its global payment technology in 2016.

- Ghanaian fintech, Dash, raises $32 million seed for mobile wallet app development in Africa.

- Indonesia-based digital wallet, DANA, raised $100M in series B funding to create mobile app for the unbanked.

- Middle-east, and north-Africa-based fintech, Hubpay, raises $20 million for its e-wallet solution.

Case Studies of Successful Digital Wallet Companies

Multiple companies thrive in this niche due to their innovation, the effectiveness of their business model, and the operating region.

Here are examples of startups that can inspire your offering:

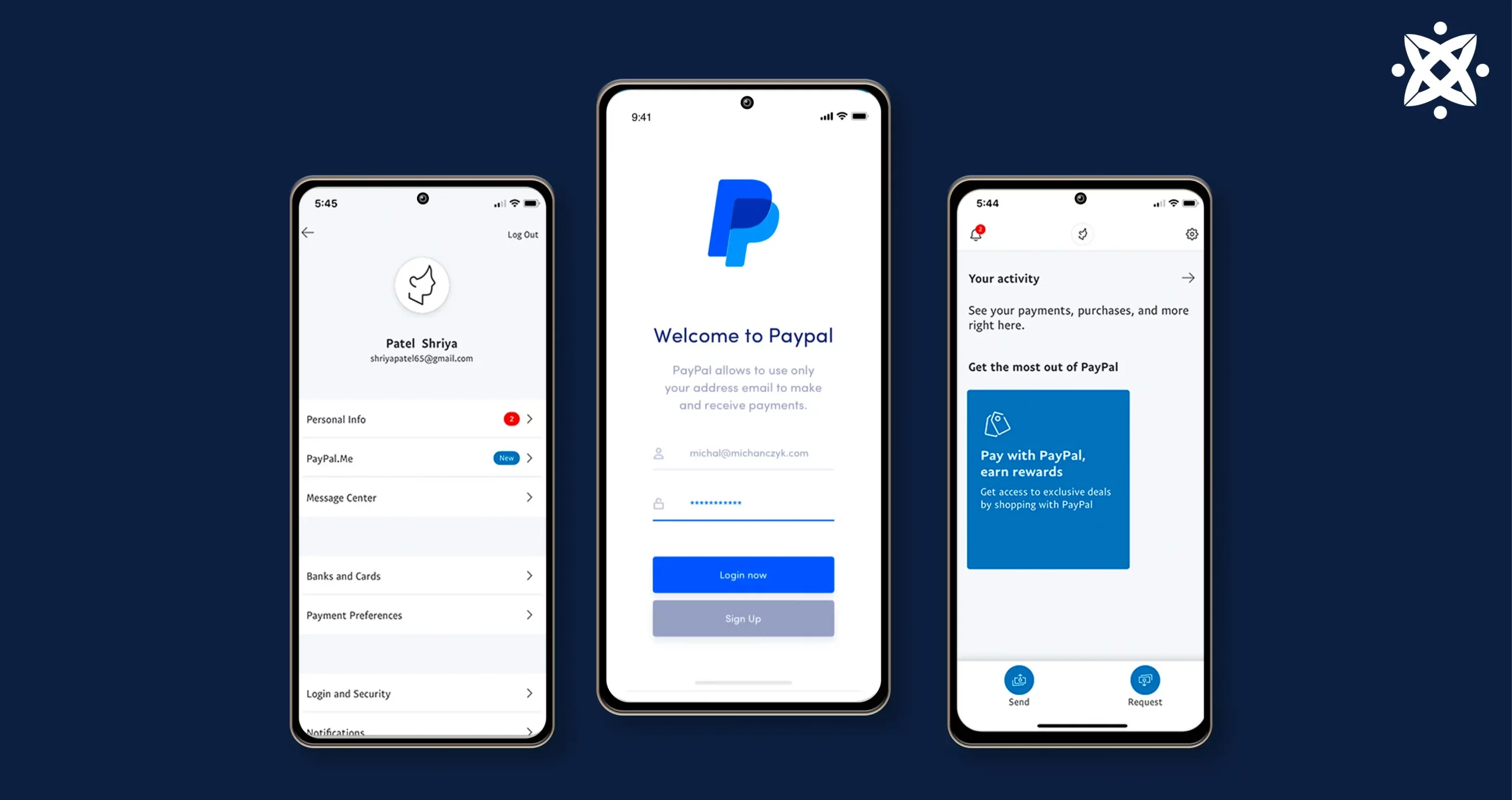

Case Study #1: PayPal

PayPal is a peer-to-peer payment system enabling users to obtain money from other account owners, irrespective of geographical restrictions.

Albeit originally established in March 2000, it rose to fame when eBay purchased it in 2002 for $1.5 billion.

Motivation Behind PayPal

Max Levchin founded PayPal to provide consumers with a secure, fast, and cheap alternative to the traditional means of sending and receiving funds.

They aim to shield users from bottlenecks prominent in traditional banking institutions.

PayPal’s Growth Business Model

The company had skyrocketing success in its earlier years mainly due to its referral marketing strategy.

Providing new sign-ups and their referees a sign-up bonus of $20, $10, and eventually $5.

This strategy gave it a 10% daily growth in the early 2000s.

Cost of Creating a Mobile App Like PayPal

The cost of creating an electronic wallet app like PayPal costs between $40,000 and $90,000.

Discuss your e-wallet app idea with us. Our expert app development consultant will share customized quotes according to your requirement.

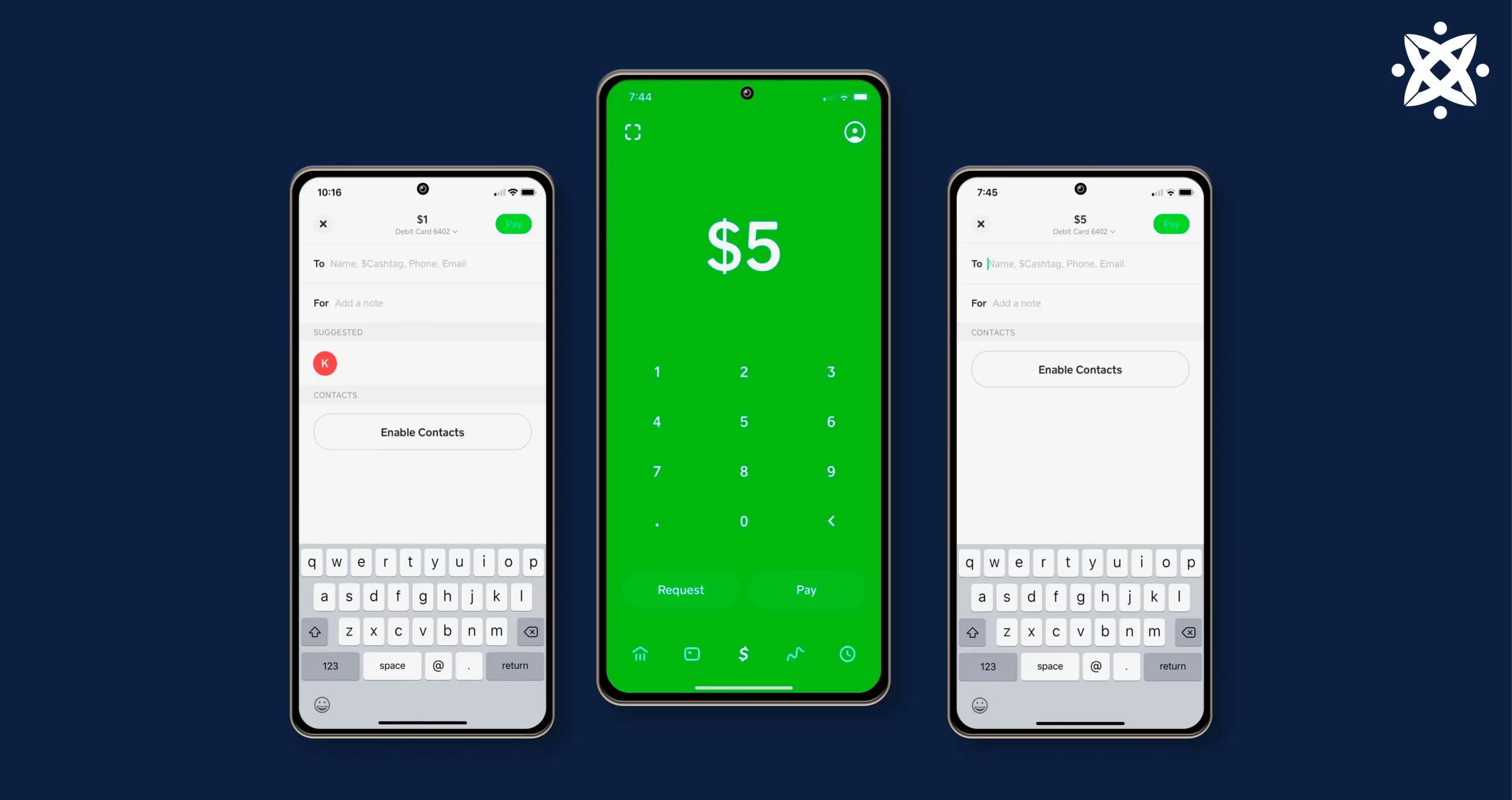

Case Study #2: Cash App

Cash App is a peer-to-peer payment solution that lets its users send and receive via its mobile application.

This fintech mobile application provides a range of banking services and issues debit cards through its partners.

Motivation Behind Cash App.

Cash App, originally known as Square Cash, is an e-payment platform co-founded by Jack Dorsey.

The original inspiration for the innovation occurred to Dorsey in 2009 when Jim McKelvey (Dorsey’s friend) couldn’t complete a $2,000 sale because he didn’t accept credit card payments.

Thus, Cash App is built for quick and easy transactions.

Cash App has achieved these goals by offering standard deposits to bank accounts and quick deposits to linked cards.

Cash App’s Business Model

The most recent contribution to the company’s growth is Bitcoin purchases.

The company’s bitcoin revenue grew from $510 million in 2019 to over $10 billion in 2021.

Cash App offers free deposits, with 1-3 days of transaction time. Instant deposits are required to pay a 0.5% – 1.75% transaction fee.

With this model, the company generated a revenue of $12.3 billion in 2021.

Cost of Creating a Mobile App Like Cash App

The cost of creating a mobile application like Cash App typically ranges between $30,000 and $55,000.

Read this article on app development cost for better insight on the price estimate of developing a similar mobile application.

Now that you know that success is achievable with your e-wallet app startup idea. How do you get started?

Let’s discuss a step-by-step way to create your app.

How to Create an E-Wallet Mobile App: A Step-by-Step Guide

Ensure your payment mobile platform development process aligns with the checklist below to guarantee a resilient, stable, and viable product.

Take a glance at this 4-step checklist, and come up with creative strategies that align with it.

- Conduct extensive market research

- Verify the market acceptability of the app idea

- Create technical requirements

- Create UI/UX mockups

- Build interactive prototypes

- Make the MVP

- Launch, maintain, and support.

The list above is just a succinct checklist to glance through. As such, let’s delve into an elaborate description.

Step 1: Discovery Phase

The discovery phase, also called scoping phase, is a stage where the development team brainstorms under the coordination of Project Management to identify the technical requirement needed to match the idea’s business model.

It aids every team member in understanding the intricacy of the solution to better engage the tech stacks in the right way.

An ideal discovery phase should adhere to this checklist:

- Uncover the founder’s motivation and objectives

- Research the target users

- Create project workflow

- Create a project blueprint.

Let’s discuss what each point entails:

1. Understand the Mobile App Idea

The business analyst and project manager will hold meetings with the client to understand their app idea and the uniqueness of the solution.

Meeting notes are communicated with other team members.

2. Research about Target Users

Conduct extensive research on the preferences of target users.

This guides the UI/UX designer on appropriate colors, buttons, and icons to use.

It also guides other business-centric decisions.

3. Create a Project Workflow

The project workflow is the sequence of tasks needed to be completed to have the expected deliverable.

The CTO or tech lead determines the features and functionalities required to bring the project to completion.

4. Create a Blueprint

The blueprint is a document that helps determine the requirements you need in software development, such as systems and hardware.

It also contains every feature, functionality, milestone, and deadline for the deliverable.

It’s an actionable guide for team members, clients, and the management team.

Although easily underrated, it’s a very crucial pre-development step.

It sets the foundation for developing the solution by ensuring that the development team understands the objectives, competitors’ weaknesses and strengths, and your target users.

This way, the product will have an optimized impact on prospective audiences.

Beyond the generic information curation process of the discovery phase, some key aspects require special attention:

-

Technical Aspects to Focus on In the Discovery Phase:

| Aspects | Description |

|---|---|

| Regulatory compliance | Here, the team should identify regulatory laws within their geography of operation and ensure deliverables adhere to them. |

| Data safety | Due to the sensitivity of information exchanged in financial transactions; the team should draft safety measures to keep the mobile app safe. |

| Risks identification and reduction | Here, the team maps out possible things that can go wrong while developing, launching, or scaling the app. Techniques to use here entail:

For optimum outcome, it’s best to analyze both Android and iOS app development software. |

Another vital phase here is the design step. Let’s shed more light on it:

Step 2: UI/UX Design

The UI/UX design phase entails creating a pictorial view of the app’s interfaces and the experience users get from using the product.

The expert here creates a mobile app design depicting every icon, button, and feature of the software.

The design is a first-hand guide for the mobile developers’ coding process.

Once the design phase is completed, deliverables that’ll be passed to the next step include a user interface design for different operating systems and a UX wireframe.

The designer may also create prototypes, i.e. interactable designs, for the client and development team to approve the milestone before moving to the coding phase.

Making a prototype can help to highlight unanticipated technical, compliance, or physical constraints, thereby improving product responsiveness, usability, and efficiency.

For the Design phase, the activities here entail:

| Activity | Required Hours |

| Mindmapping | 20 |

| UI design | 40 |

| UX design | 60 |

| Total for design | 120 |

Once this step ends, the next phase is to start the core coding process. Let’s delve into this:

Step 3: Development and Testing Phase

The development and testing phase is the most technical aspect of mobile wallet app creation.

We won’t delve into the technicalities of this aspect as your programmer or your mobile app outsourcing agency will shoulder the development.

Factors that determine the success of this phase is the UI/UX design, tech stacks, and, most importantly, the skill set of the developers involved.

Depending on your development’s overall goal, this phase’s outcome should either be an MVP or a fully-scaled solution.

-

Activities Involved in App Development and Testing

Below are the activities and estimated time frame that’ll be expended on these tasks:

| Activity | Required Hours |

| Software architecture | 25 hrs |

| Backend development | 175 hrs |

| Frontend development | 175 hrs |

| Debugging | 40 hrs |

| QA testing | 80 hrs |

| Total Development Hours | 495 hours |

But what features will be created in this coding process? Let’s shed some light on it:

-

List of Features for an MVP of a Mobile Wallet Application

If you’re creating a minimal viable product for your solution, then it should only have core features needed to perform essential operations that entail:

| Features | Description |

|---|---|

| User Authorization | User authorisation is a control restriction feature that safeguards the mobile app and ensures only individuals with required access can use the mobile app.

Doing this creates a controlled environment to protect financial information and users’ personal information. This is required by law in the US and UK. |

| User Profiles | This entails information that is specific to the user and enables them to get personalized offerings. The information on the user profile helps to identify the account owner. |

| Bank and Card Integration | It’s imperative for the mobile app to be integrated into a debit/credit card or bank account to enable deposits and withdrawals. |

| E-Receipts | An E-receipt is proof of payment that a financial transaction has successfully occurred on the mobile application. |

| Pop-up Notifications | This feature is an in-app message to the application user. It’s particularly essential in the mobile pay app development stage to notify the user of a successful or failed transaction. |

However, if you want a full-service solution, then you’ll have to implement more features to guarantee a better user experience.

Talk to our professional mobile app development consultant. Let’s analyze your requirements and develop a custom digital wallet mobile app with advanced features.

-

List of Advanced Features for Full-Service Wallet Payment Apps

The features to include when creating a full-service solution are:

| Features | Description |

|---|---|

| Online currency conversion | To get a mobile app developed and accessible across different regions, it’s imperative to have online currency conversion for seamless cross-border payments. Take a cue from Payoneer. |

| Cashback system | The cashback system repays users for money spent. The necessity of this feature depends on your marketing model. |

| QR code scanner | The QR code scanner is an extra feature that aids security in cross-platform account access. |

| Social user authentication | This feature allows users to sign in to their phone wallet app by logging in to their social media accounts. |

| Payment scheduler | This feature helps initiate a financial transaction well before a specific payment date. |

Now that you know the features that’ll be created in the mobile development process let’s discuss the professionals needed to make your own app.

-

Required Team For Digital Wallet Mobile App Development

Your application’s quality is directly linked to the expertise and versatility of the development team and tech stacks.

Here are the team you’ll need to create your solution:

| Required Team | Job Description |

|---|---|

| Mobile developer | The mobile developer writes codes for the mobile application user interface according to the UI/UX designs.

They ensure that APIs from the backend are appropriately integrated and that all features function according to the project’s blueprint. |

| Backend developer | The backend developer writes server-side codes that serve as the solution’s core functionality. |

| UI/UX designer | The UI/UX designer creates a pictorial view of the mobile application by providing stakeholders with mockups and prototypes of the solution. |

| Project manager | A product manager coordinates the development team and allocates requisites tasks based on their skill set. They also set a timeline for creating features. |

| Business analyst | The business analyst conducts research and analysis to improve the market friendliness of the digital wallet app. |

| QA tester | The QA tester checks the deliverable to ascertain that it aligns with the client’s expectations.

They also perform a series of tests to ensure the solution’s resilience, usability, security and scalability. |

-

Tech Stacks for Digital Wallet App Development

You should partner mobile app development services with requisite knowledge at list one tech stack in the following categories:

| Aspects | Tech Stacks |

| Backend Development | Java, Node.JS, Next.JS, Laravel, GoLang, Python |

| Mobile Development | Kotlin, ReactNative, Swift |

| Database Management | GraphQL, MySQL, MongoDB |

| UI/UX Design | Principle, Figma, AdobeXD |

| Hosting | Amazon Web Service, Microsoft Azure, or any alternative |

| Project Management | Confluent, Jira |

Note: This step is where most app development processes fail.

It requires top-notch expertise, experience, and attention to detail.

As such, it’s imperative to partner with a mobile app development company with verifiable proof of experience.

At Intelivita, we help fast-growing startups get the best out of mobile technology with our team of fintech developers that are committed to creating pathbreaking digital wallets.

Once the solution is created, the next step is to launch your application.

Step 4: Mobile App Launch

This step involves hosting your mobile application on platforms like Google PlayStore, AppStore, etc.

This makes your product accessible so users can download them onto their operating systems.

Beyond product launch, other aspects to consider here.

Product maintenance is the process of keeping the application updated, active, bug-free, error-free, and valuable for its requisite purpose.

The app is also maintained by getting feedback on features from users and regularly making adjustments to ensure an improved user experience.

An MVP may be scaled if the user experience is certified to fit expectations.

For features to include in product scaling, revert to the previous section of this article on the list of advanced features for full-service web payment apps.

How Much Does it Cost to Develop an e-Wallet App?

An e-wallet app development cost ranges from $15,000 to $40,000.

For precise cost implication, you’ll have to consider factors affecting the price of e-wallet apps, some of which are:

- The location of the development team

- The tech stacks used in product development

- The type of team involved (In-house, freelance, offshore, and local development team)

- Government regulations in area/country of operation

- The complexity of the project

- The UI design of the app.

Albeit all these factors and more affect cost of creating an e-wallet solution, the most key-cost impact is from the team type, and their location:

Factor 1: Cost Defined By Team Type

As with any app development cost, the price of creating a digital wallet solution is impacted by team type.

Based on team type, the options for e-wallet development are:

- In-house development team

- Freelance team

- Local development agency

- Offshore development firm.

The value proposition and relevance of each team type should be a core determinant of your choice.

Thus, per the complexity and effectiveness of an app, startups may aggregate an in-house workforce with a compendium of the best digital wallet developers.

Alternatively, enterprises in need of a perfect cost-quality ratio will opt for a development agency.

Also, there are also hundreds of freelance programmers at an excellent cost, however, there is a multitude of risks to consider.

All these options offer the same service with equally proposed end goals, but there’s a significant difference in their throughput, costs, and quality.

Here’s how the cost of digital wallet app development differs per team type:

| Team Type | Cost |

| In-house | $85,000 |

| Freelance | $30,000 |

| Software Development Agency (India) | $30,000 |

Since price isn’t the only cost-determining factor to consider, let’s help you understand the intricacy of your options to know which best suits your company:

Team Type 1: In-house Development Team

An in-house development team is an internal workforce of employees. They’re hired directly by your human resource team and report directly to your company’s management.

- Pros and Cons of In-house Team for Digital Wallet App Development

| Pros | Cons |

|---|---|

|

|

Team Type 2: Freelance Team

A freelance team is a workforce of independent programmers you can employ to help create an e-wallet mobile application.

They work on a per-contract basis for a predetermined timeline and don’t owe loyalty to any organization.

Here are the pros and cons of this option:

| Pros | Cons |

|---|---|

|

|

Team Type 3: Software Development Agency

A software development agency is a full-service solution provider that creates bespoke web and mobile applications for clients per specification.

They also outsource dedicated developers to companies for a specific timeframe.

For the best cost-quality ratio, it’s best to outsource your digital wallet mobile application development to an offshore company, particularly one based in India.

Here are the pros and cons of opting for an offshore-based software development firm:

| Pros | Cons |

|---|---|

|

|

Another cost influencing factor to consider is the location of your development team.

If you’re outsourcing digital wallet software production, then consider location. Here’s what it entails:

Factor 2: Cost Defined By Location

The cost of digital wallet app creation varies per location.

Difference in development fee is often dependent on the price of living in each country.

For example, the minimum wage in the US is $7.25/hour, while the cost of hiring a senior full stack fintech developer is $85/hr.

In comparison, the minimum wage in India is $2 per day, while hiring a senior digital wallet full stack developer is $15/hr.

As you can see from above, even for the same skillset and year of experience, the price differs per location.

Let’s break down the cost of developing a digital wallet application per country.

| Country | Cost of creating e-wallet mobile application |

| USA | $200,000 |

| United Kingdom | $190,000 |

| Canada | $180,000 |

| Australia | $180,000 |

| India | $45,000 |

Looking for a Reliable Technical Partner?

Now that you’re educated on the processes involved in how to develop a digital wallet app.

What’s next?

Partner with us to turn your app idea into a high-demand and scalable live application that appeals to your target users.

At Intelivita, we have a team of experienced developers with the requisite knowledge to create mobile applications of varying complexities.

Within a few months, we’ll help you develop your own app.

Uncertain about our capacity to deliver?

Check through our case studies and verifiable reviews on Clutch.

Bonus Infographic

You can find a summary of our detailed guide “eWallet App Development” in the form of an infographic that explains how to develop an e-wallet application, market overview for digital wallets and how to determine the cost of ewallet mobile application.